Financial Year 2024 in India

Financial Year 2024: Everything You Need to Know in India

As we step into Financial Year 2024, it’s essential to understand the key aspects that will shape our financial landscape. From tax changes to economic policies, here’s a comprehensive guide to navigating the financial terrain in India this year.

1. Budget Highlights: The Union Budget 2024 allocated Rs. 11.47 lakh crore for infrastructure development, including roads, railways, and ports. This investment is expected to boost economic growth and create job opportunities. The budget also allocated Rs. 2.23 lakh crore for healthcare and wellness, focusing on strengthening healthcare infrastructure and improving access to healthcare services.

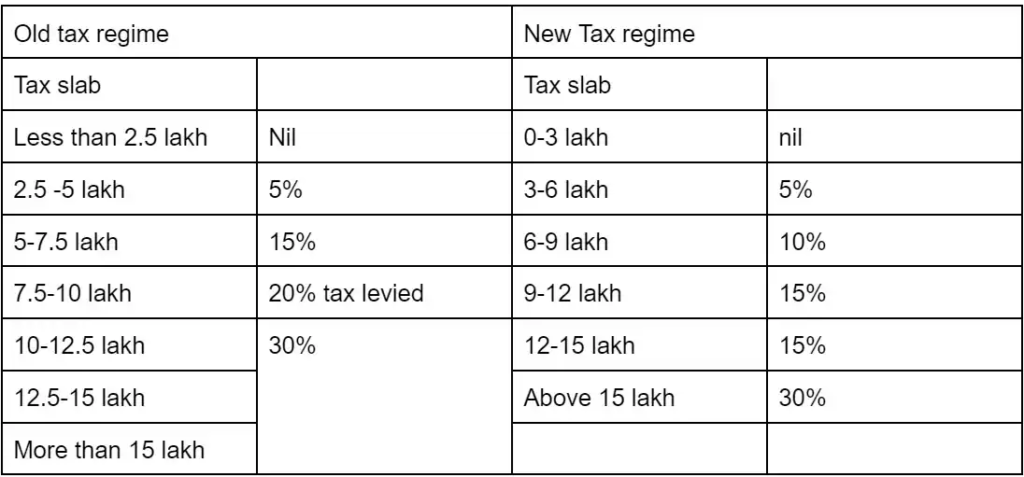

2. Taxation Changes: The new tax regime introduced in Financial Year 2020-21 offers lower tax rates but without exemptions and deductions. For example, under the new regime, the tax rate for income between Rs. 5 lakh and Rs. 7.5 lakh is 10%, compared to 20% under the old regime. Taxpayers can choose between the old and new regimes based on their income and tax-saving preferences.

3. Investment Opportunities: The focus on infrastructure development presents lucrative investment opportunities. For instance, the government’s National Infrastructure Pipeline (NIP) aims to invest Rs. 111 lakh crore in infrastructure projects over the next five years. Investors can consider investing in sectors such as roads, railways, and renewable energy to benefit from this growth.

4. Digital Transformation: India’s digital economy is witnessing rapid growth, driven by initiatives such as Digital India and the rise of digital payment systems. For example, the Unified Payments Interface (UPI) has emerged as a popular digital payment method, with over 4 billion transactions worth Rs. 6.4 lakh crore in February 2024. Businesses can leverage this digital shift to reach a wider audience and streamline their operations.

5. Regulatory Changes: The regulatory environment is evolving to address emerging challenges. For example, the Personal Data Protection Bill, 2021 aims to regulate the processing of personal data and protect individuals’ privacy. Businesses need to comply with these regulations to avoid penalties and maintain consumer trust.

6. Economic Outlook: Despite global economic challenges, India’s economy is expected to rebound and grow at a robust pace. The International Monetary Fund (IMF) projects India’s GDP growth at 7.4% in 2023-24, making it one of the fastest-growing major economies. This growth is driven by reforms, infrastructure development, and a young workforce.

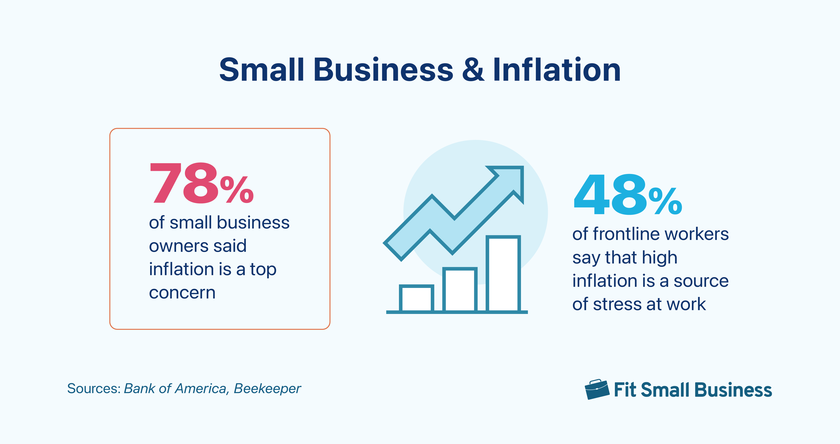

7. Impact on Small Businesses: The budget announced several measures to support small businesses, including increasing the turnover limit for small businesses for presumptive taxation from Rs. 2 crore to Rs. 5 crore. This move is expected to benefit small businesses and reduce their tax burden.

8. Employment Opportunities: The focus on infrastructure development is expected to create millions of new jobs across various sectors. For example, the construction of new roads and highways is expected to create jobs for engineers, construction workers, and support staff.

9. Export Opportunities: The government’s focus on boosting exports presents opportunities for businesses to expand their reach to international markets. The Production-Linked Incentive (PLI) scheme aims to boost manufacturing and exports in sectors such as electronics, automobiles, and pharmaceuticals.

10. Sustainable Development: The budget emphasized sustainable development, with investments in renewable energy and clean technologies. This focus on sustainability presents opportunities for businesses to innovate and develop environmentally friendly products and services.

In conclusion, Financial Year 2024 presents a promising outlook for India’s economy, with opportunities for growth and investment across various sectors. By leveraging these opportunities and adapting to the changing landscape, businesses and individuals can navigate the financial year successfully and achieve their goals.