Filing Income Tax Returns in Bangalore for FY 2023-24

Introduction

Income tax return filing is a scheduled process for every taxpayer and has to be filed every year. The income tax return filing is also a mandatory process to be followed for multiple reasons including financial and record maintenance while beneficial for the future loan perspective. It is to be noted that the due date for filing the Income Tax Return by Assesse is 31st October 2024 for all the Audit cases and for the Non-Audit cases the due date is 31st July 2024. The due date for filing of the Income Tax Return by the assessee who is required to furnish a Report under section 92E is 30th November 2024.

Latest Update

According to the latest data on direct taxes, there has been a significant improvement in taxpayer compliance.

Note down it is very important for all the assessees to file income tax returns online having an income of 2.5 lacks per annum (excluding senior citizens) and to claim a refund. While it is a significant process, it is also easy to track refunds and ITR returns online.

Why You Must File ITR Before 31st March 2024?

It will be more correct, to make sure that all the details of the accounts are true, the ITR returns on filing need much more attention. For avoiding errors one needs to check documents, tax statements, interest income certificates, etc. If one returns ITR then the chances of errors become lesser.

Payment Interest– the assessee who has to pay a tax of more than 1 lakh has to file earlier so as to increase interest payment on a monthly basis. Failure to file returns will levy a 1% interest for every month.

The loss will be moved forward: the Income-tax plan is to take ahead the losses from one fiscal year to another. although, taxpayers can avail of this if they file ITR before the expected last date.

Quick Refund: if the taxpayers file their return before November 30 then refunds can be processed who are waiting for the same. Earlier ITR filing may be confirmed before it gives quick tax rebates.

Let’s Come to the Step by Step Process of ITR Filing FY 2023-24:

Document organization

- The taxpayers will have to obtain all the documents of monetary value i.e. income, investments, assets, and bank accounts apart from government documents like Permanent Account Number (PAN) and Aadhaar number or Aadhaar enrolment ID. It is not necessary to attach these documents while filing ITR online but still one needs them to fill out the form due to the details engraved on them.

- Also, the documents related to income other than salary, like capital gains, rental income and dividend income will also be needed while filing the IT online and it is also suggested that the taxpayers should maintain a separate file of documents for every previous ITR filed.

Document Checklist For Filing ITR Online

The most important thing that the assessee would require to start with the filing of ITR is the required documents. Documents the assessee would need to vary depending on the type of income he has:-

Personal Documents

- PAN Card

- Aadhaar card or Aadhaar enrollment number

- Details of domestic assets and liabilities

- Details of foreign assets

Income-related Documents

- Bank statement

- Interest statement of the year

- Details of all bank accounts held during the year( IFSC code, account number, name and nature of account)

Tax-related Documents

- Copy of last year’s tax return

- TDS certificate

- Saving certificate or deduction

- Form 26AS to cross-check TDS details

Real Estate-Related Documents

- Buyer agreement, sale deed and investment documents to show capital gains on sale and details of exemption if availed or not

- Lease deed to show rental income

Investment and Expense Related Documents

- Home loan statement to claim a deduction on Principal amount and interest on home loan

- Proof of investment such as mutual funds account statement

- Premium receipt for life insurance plans

- Medical insurance premiums and preventive checkup receipts, etc.

Other documents such as proof of donation

Create an ITR e-filing Account

After having all the desired documents handy, one must log in to an ITR e-filing account through the income tax department’s website. The details like user ID (your PAN) and password will be needed for logging.

However, if a taxpayer is a first-time ITR filer then he may create an ITR e-filing account on the same website with few other details.

ITR Form Selection

After logging into the ITR e-filing account, one must click “filing of the income tax return” on the dashboard. Then select the assessment year (AY) for which the taxpayer has to file ITR. After which choose the ITR form. For Individuals and HUFs having income from profits and gains of business and profession ITR 3 is mandatory. For Individuals, HUFsand Firms(other than LLP) being resident and having total income up to Rs 50 Lakhs and income from business and profession which is computed under section 44AD or 44ADA or 44AE ITR-4 is to be filed( Not for individuals who is a director in a company or have invested in unlisted equity shares).

According to a tax expert, “ITR-1 is not applicable to non-residents and not ordinarily residents, the ITR-2 form is no longer applicable for individuals or HUF (Hindu Undivided Family) who have profits and gains from any business or profession and are required to file form ITR-3.”

In case one selects the wrong ITR form, the particular form is considered to be defective so it is advisable to be cautious. Swapping of ITR forms is also not suggested as for example ITR 1 and ITR 2 are 2 different forms. ITR 2 is for those having an income of more than 50 lakhs and having 1 or more houses while ITR 1 is for those who are having less than 50 lakhs of income and a single house.

So in case, a person filed ITR 1 instead of ITR 2 then it would be considered as under-reporting of income and it would draw a certain penalty which ranges from 50 to 200%.

Various ITR Forms and their Applicability:

- ITR 1 – For Individuals residents (Not Ordinarily Resident) having total Income upto Rs.50 lakhs, Salaried income, single House Property, Other Sources Income (Interest, Dividend etc.), and Agricultural Income upto Rs.5 thousand (Not applicable to Individuals being Director in a company or has invested in Unlisted Equity Shares)

- ITR 2 – For Individuals and HUFs not having income from profits and gains of business or profession

- ITR 3 – For Individuals and HUFs having income from profits and gains of business or profession.

- ITR 4 – For Individuals, HUFs and Firms (other than LLP) being a Resident having a total of up to Rs.50 lakhs and having income from business and profession computed under sections 44AD, 44ADA or 44AE (Not applicable to Individuals being Director in a company or has invested in Unlisted Equity Shares)

- ITR 5 – For persons other than:-

- (i) Individual,

- (ii) HUF,

- (iii) Company and

- (iv) Person filing Form ITR-7

- ITR 6 – For companies other than those claiming exemptions under Section 11

- ITR 7 – For persons including companies required to furnish returns under sections 139(4A) or 139(4B) or 139(4C) or 139(4D)

Note: Income earned in the previous year is called a financial year, while an Assessment year is a year succeeding the previous year in which the taxpayer assesses their income and files his return of income.

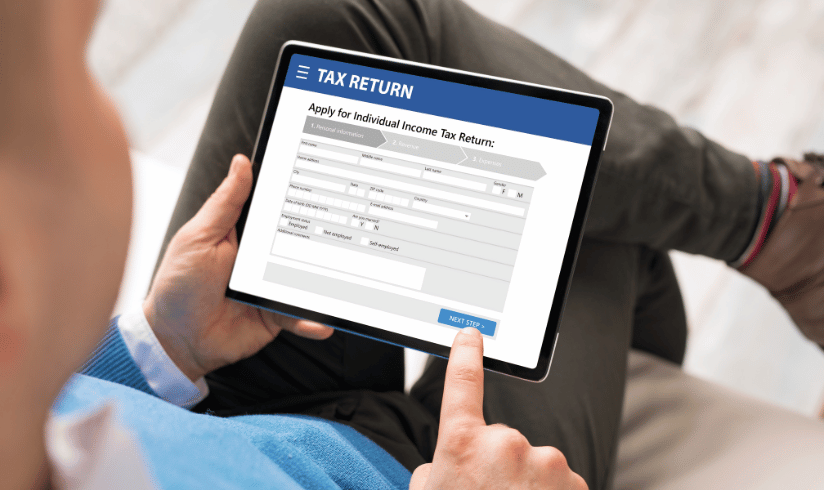

Filling Out Details

The first and foremost details are the Aadhaar number or Aadhaar enrolment ID which is mandatory to file an ITR return online as the system won’t allow the filing of returns online without this information.

According to the expert, “ITR forms are seeking a lot of new information like the break-up of salary and house property income to be furnished in ITR-1 form instead of a single amount of income/loss, as required to be furnished earlier.

E-verification of Returns & Uploading

The last step to file the IT return is to verify your details and upload them on the portal. The ITR window will remain open for 30 days to get your return verified from the date of return submission. One can also send a duly signed copy of ITR V to the Central Processing Center tax department by ordinary or speed post.

Disclaimer

All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check.